In the early to mid-July, downstream traders entered the market in a concentrated manner for procurement, providing demand support. Magnesium prices rebounded several times, but were constrained by factors such as lower order prices received earlier, resulting in a fluctuating rangebound trend for magnesium prices. In the late July, the positive effects of the "anti-rat race" competition policy began to emerge, and the commodity market continued to heat up. The ferrous metals sector also rose in tandem, strongly driven by the soaring coking coal prices. Affected by the sharp jumps in the prices of core raw materials for primary magnesium, such as coal and ferrosilicon, coupled with the favorable conditions for a phased upward movement in the magnesium market's fundamentals, magnesium prices broke through the 17,000 yuan mark, rising to 17,100-17,200 yuan/mt.

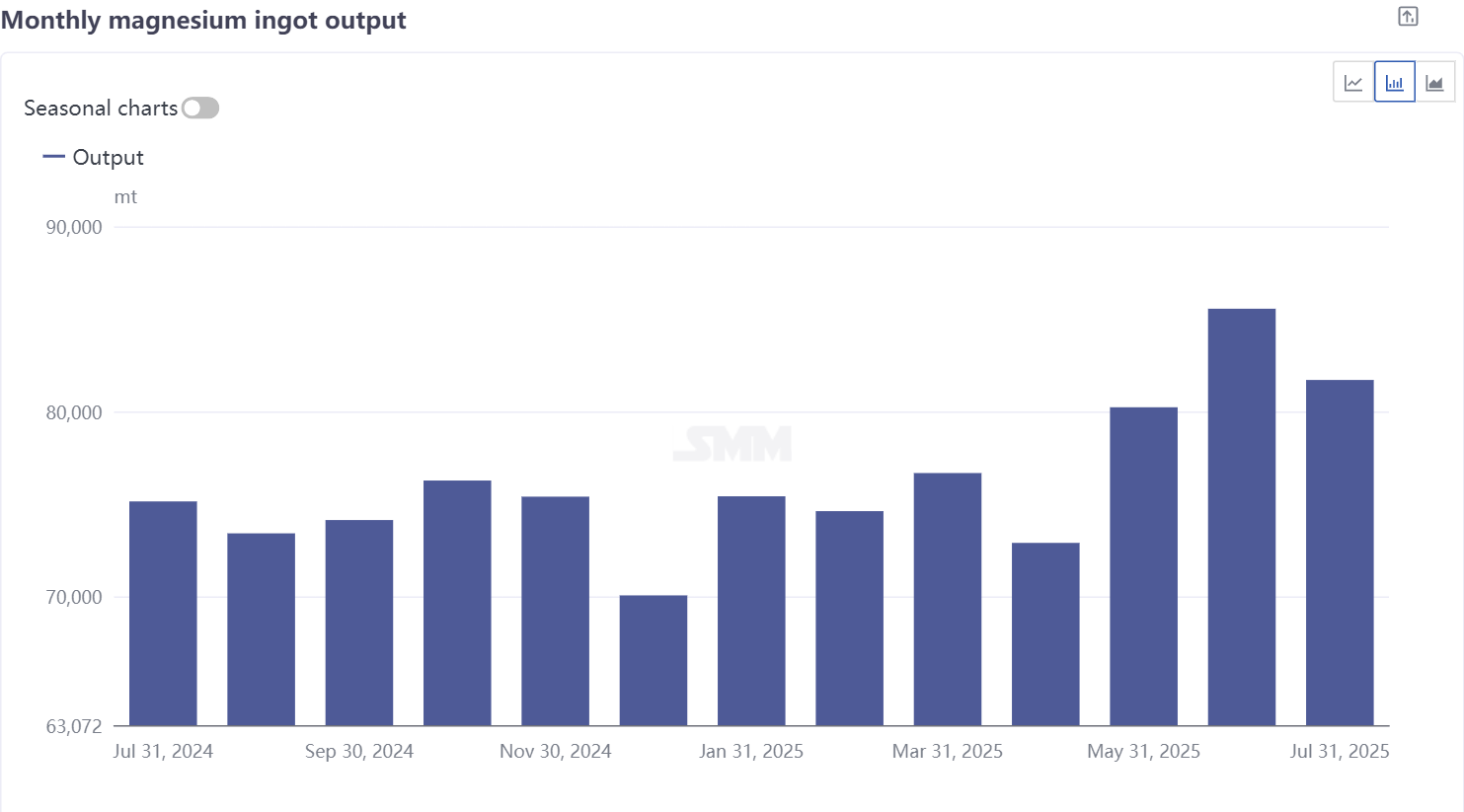

According to SMM data, China's primary magnesium production in July 2025 decreased by 4.50% MoM and increased by 1.82% YoY, with the operating rate dropping to 61.86%. After two consecutive months of increase, primary magnesium production in July showed a slight decline, mainly due to the following reasons: 1) High temperatures in production workshops made it difficult for employees to endure, leading to an increase in the frequency of leave requests and extended smelting cycles. These situations caused nearly 70% of primary magnesium smelters nationwide to experience a slight decline in production. 2) Primary magnesium smelters in the main producing areas conducted normal maintenance shutdowns of equipment. According to SMM statistics, a total of four smelting enterprises underwent maintenance shutdowns in July. 3) Concentrated rainfall in the main producing areas in the late July led to a short-term decline in the daily production of some magnesium plants in the main producing areas. However, it is worth noting that three primary magnesium smelting enterprises resumed production and produced magnesium ingots in July. Affected by this, primary magnesium production increased somewhat. Overall, the reduced production of primary magnesium exceeded the increased production, resulting in a downward trend in China's primary magnesium production.

According to the SMM survey, currently, five primary magnesium smelting enterprises in the main producing areas have reported plans for maintenance shutdowns in August. Additionally, three primary magnesium smelting enterprises that underwent maintenance in July are expected to resume production in August, while the specific resumption times for other previously shut-down primary magnesium smelting enterprises are undetermined. SMM will continue to track this situation. Overall, the production of domestic primary magnesium smelting enterprises in August is expected to decrease slightly.

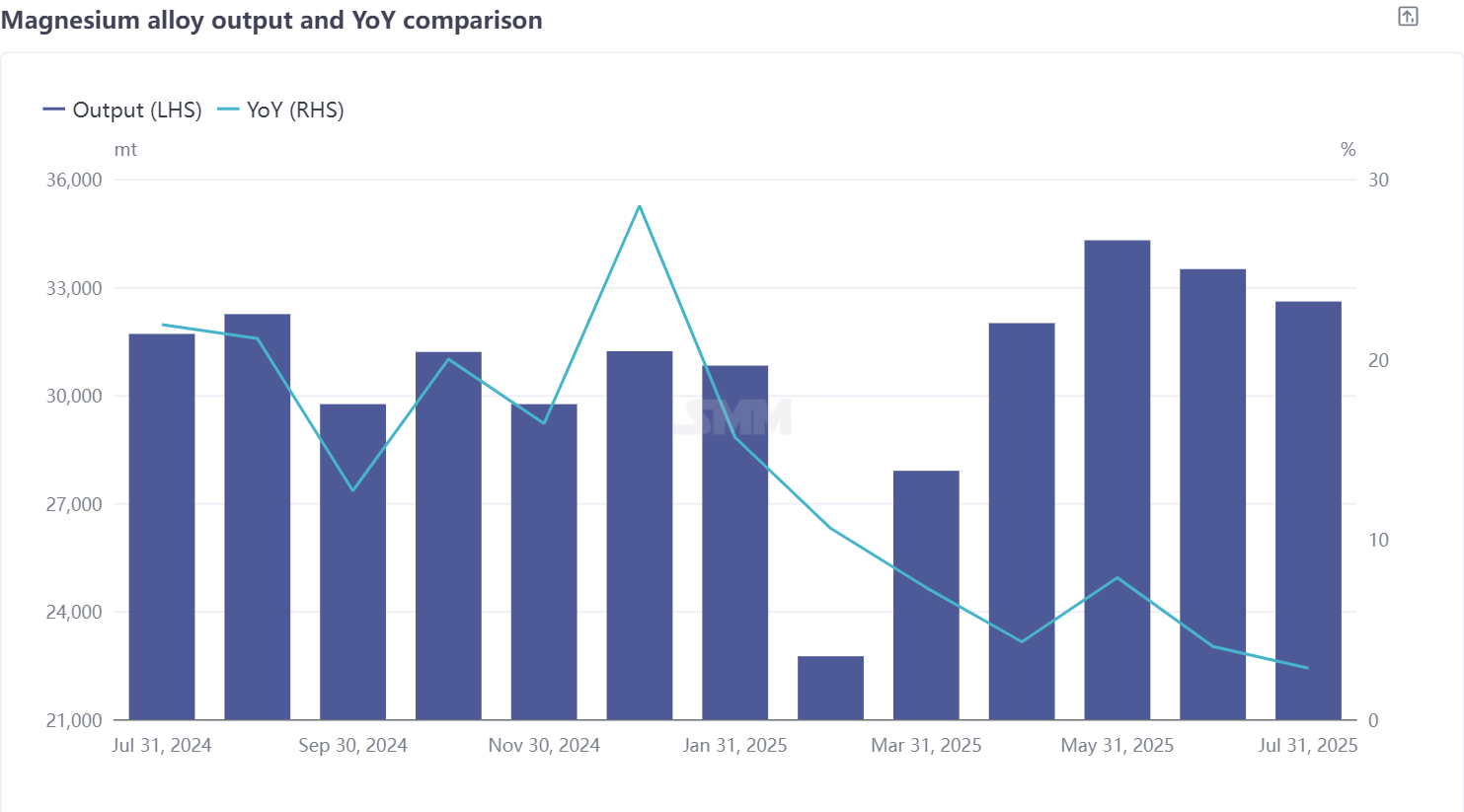

SMM data shows that China's magnesium alloy production in July 2025 decreased by 2.69% MoM and increased by 2.83% YoY, with the magnesium alloy operating rate dropping to 57.44%. Magnesium alloy production in July maintained a downward trend, which was mainly due to the spontaneous reduction in the operating rate of magnesium alloy manufacturers triggered by sluggish demand. The main reasons for the decline in magnesium alloy production are as follows: Firstly, with the change in seasonal factors, the market has shown signs of the off-season, and procurement volumes have declined recently. Secondly, the magnesium alloy market has recently entered a fatigue period after a concentrated rush to export, leading to a decrease in overseas orders for magnesium alloy. Affected by this, some magnesium alloy manufacturers have reduced their operating rates.

Looking ahead to August, as mainstream producers continue to intensify market promotion efforts, the cost-effectiveness advantage of magnesium alloy materials is gradually gaining widespread recognition in the industry. This trend has prompted some die-casting enterprises to begin adjusting their production processes and gradually replacing aluminum alloy with magnesium alloy. Although this material substitution has not yet generated large-scale orders, it has driven an overall mild increase in market demand for magnesium alloy, which will bring about a certain degree of production growth expectations. Considering the current changes in the market supply-demand pattern, the industry generally expects magnesium alloy production to maintain stable operation in August.

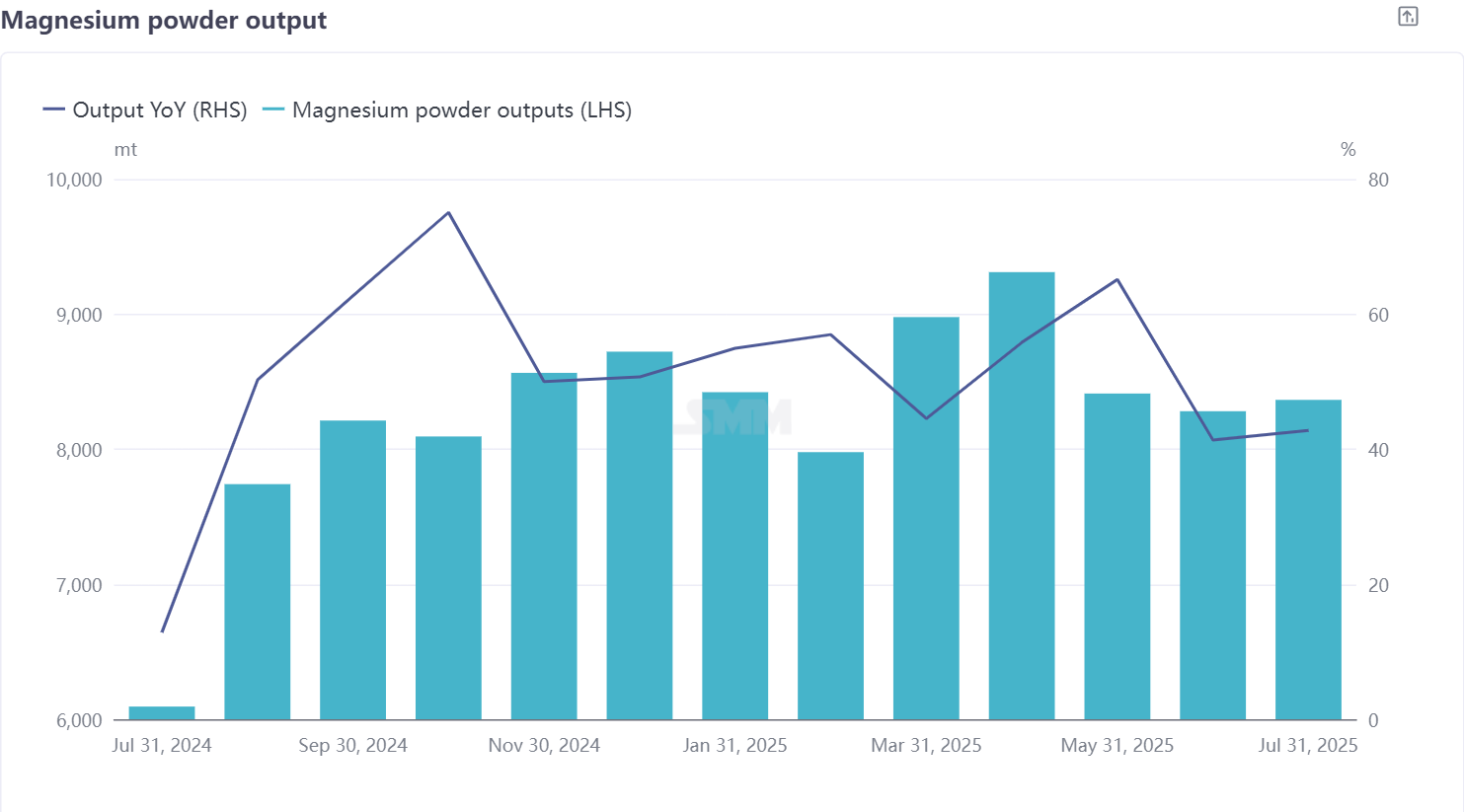

According to SMM data, China's magnesium powder production in July 2025 fluctuated rangebound, with a MoM increase of 1.02%. Market differentiation was evident in the industry, which faced dual pressures from both domestic and external demand. The domestic consumer market remained sluggish, and the shrinking procurement demand from international steel enterprises also led to a continuous decline in export orders for several months. However, some small and medium-sized production enterprises have actively reduced their capacity utilization rates, while leading manufacturers have increased their operating levels by leveraging their concentrated order advantages.

The State Taxation Administration's Announcement No. 17 of 2025 (issued on July 7, 2025) made significant revisions to the "Monthly (Quarterly) Prepayment Tax Declaration Form for Corporate Income Tax (Class A)", with the seventh provision regarding agency export declarations being viewed by the industry as a key measure to end the "export under false invoices" mode. This provision will officially come into effect on October 1, 2025, marking the beginning of a strong regulatory era for the long-standing chaos of "export under false invoices" in the foreign trade sector. Affected by this, there may be a rush to export in the magnesium powder market in August and September. Looking ahead to August, the magnesium powder industry is likely to experience a slight increase in production.